Cedar Valley News

January 20, 2026

She Built the Dream. They Took It for $3,500.

By: George Khan

From the fictional town of Cedar Valley, where characters from Quiet Echo continue to respond to real-world events.

Gloria Gaynor came to America from Jamaica in the 1960s with two children and a dream. She worked hard. She paid off her mortgage. She raised her family in the same Upper Darby, Pennsylvania home for nearly twenty-five years. Now she’s ninety-one years old, bedridden with dementia, and being evicted—because she missed one property tax payment during COVID.

Gloria Gaynor came to America from Jamaica in the 1960s with two children and a dream. She worked hard. She paid off her mortgage. She raised her family in the same Upper Darby, Pennsylvania home for nearly twenty-five years. Now she’s ninety-one years old, bedridden with dementia, and being evicted—because she missed one property tax payment during COVID.

The amount she owed? $3,500.

The value of her home? $247,000.

That’s the story running through Philadelphia’s local news right now, and it should trouble every American who believes in property rights, family inheritance, and basic human decency.

Here’s what happened. In 2020, when the pandemic had everyone frightened, Mrs. Gaynor stayed inside. She was elderly, had underlying health conditions, and didn’t want to risk catching the virus. She missed her annual trip to the tax office. The next year, she went back and paid—but her payment wasn’t applied to the previous year’s balance. The original $3,500 debt, with fees and penalties, ballooned to $14,419.

In September 2022, Delaware County sold that debt to an investment company. Under Pennsylvania law, buying the tax debt transfers ownership of the property. Just like that, a company paid $14,419 and walked away with a $247,000 house—a home Mrs. Gaynor had spent decades paying for.

Her attorneys fought it. The courts ruled against her. Now the new owners want her out.

“She’s in a hospital bed,” her daughter Jackie Davis told ABC News. “Are they going to lift the bed up with her in it and take her and put her on the steps?”

I’ve written before about neighbors helping neighbors—the people in Altadena who knocked on doors during the fires, the communities that rebuild together. But what happens when the system itself becomes the predator? When the law strips generational wealth from families over clerical errors and confusion?

Mrs. Gaynor had the money. She wasn’t destitute. She wasn’t refusing to pay. She was an elderly woman with dementia who got confused during a pandemic and didn’t understand the notices arriving in her mailbox. Her attorney put it plainly: “This is stripping generational wealth from a family. This is a sole asset that the mother had to pass on to her children.”

The investment company that bought her debt has acquired sixty-two deeds at Delaware County tax sales since 2011. They’re operating within the law. That’s the problem.

Property taxes are supposed to fund local services—schools, roads, fire departments. Nobody argues against that. But when the enforcement mechanism allows investors to seize a $247,000 home over a $3,500 debt, something has gone terribly wrong. The tax was collected. The county got its money. The only question is who profits from the $230,000 difference—and right now, the answer is a company that bought paper at an auction.

In 2023, the U.S. Supreme Court ruled that governments cannot keep surplus profits from tax sales. But Pennsylvania found a workaround: sell the properties for the value of the debt, so there’s no “surplus” on paper. The equity still exists. It just transfers to someone else.

This isn’t a story about one woman in Pennsylvania. It’s a story about what property taxes can become when we’re not paying attention. Across the country, similar cases have devastated elderly homeowners, disabled veterans, and families who fell behind for reasons that would make any neighbor wince—a hospital stay, a lost job, a spouse with Alzheimer’s who stopped opening the mail.

Here in Cedar Valley, we don’t have tax lien sales quite like Pennsylvania’s. But we have elderly neighbors on fixed incomes watching their property assessments climb year after year. We have widows in homes they’ve owned for fifty years wondering if they can afford to stay. The system varies by state, but the pressure is the same: own your home outright, and you still owe rent to the government. Miss a payment, and everything you built can disappear.

Gloria Gaynor came to this country with nothing and built something. She raised children. She paid her mortgage. She planned to leave her home to her grandson—a foundation for the next generation to build on. That’s the American Dream, or it’s supposed to be.

Instead, she’s lying in a hospital bed in her living room, surrounded by family photos and China cabinets, waiting to be told when she has to leave. A sign in her entryway reads: “May Blessings From Above Fall Upon This Home.”

She’s still waiting.

If you own your home, check on your elderly neighbors. Make sure they understand their tax bills. Offer to help them navigate the paperwork. Because the system won’t protect them. Only neighbors will.

— George Khan is a Cedar Valley resident, small business owner, and occasional contributor to this newspaper. He believes neighbors should look out for each other—especially when the system won’t.

This editorial is part of the fictional Cedar Valley News series. While the people and town are fictional, the national events they reflect on are real.

Want to know the full story behind Cedar Valley? Teresa, Caleb, Dan, and the community you’ve come to know in these editorials first came together in Quiet Echo: When Loud Voices Divide, Quiet Ones Bring Together. Discover how a small town found its way from fear to fellowship—one quiet act of courage at a time. Available on Amazon: https://bit.ly/3ME4nSs

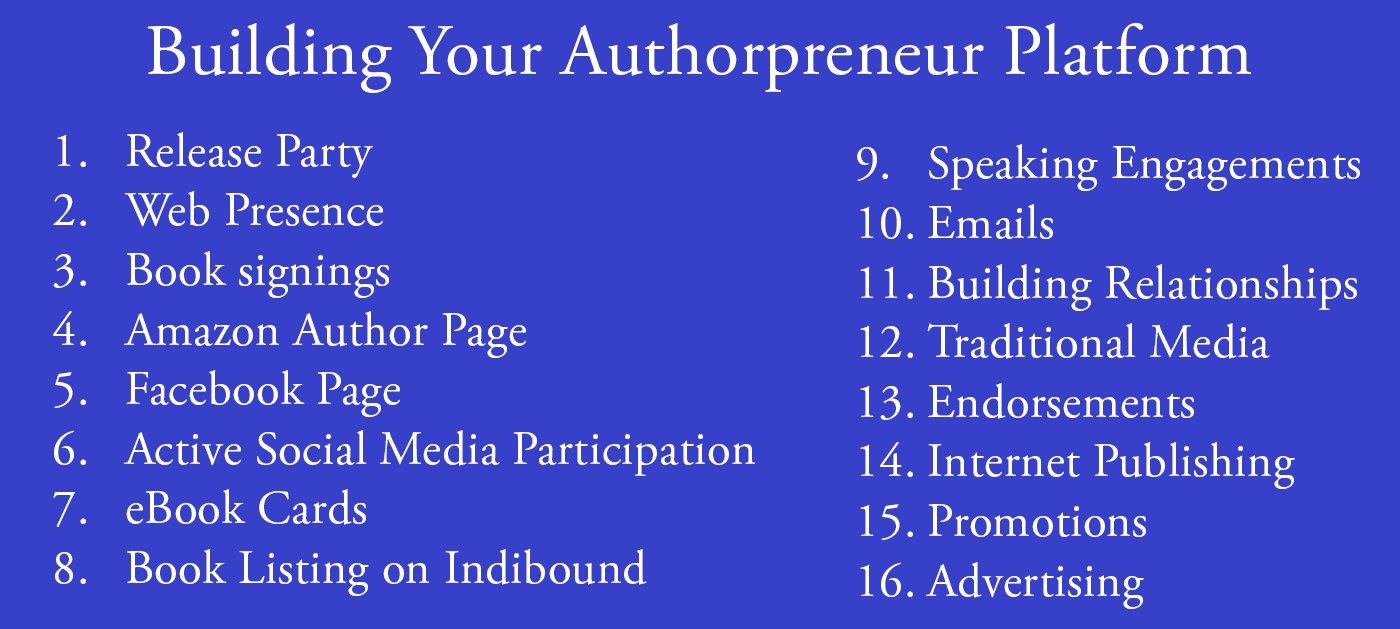

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them. Release Party

Release Party Web Presence

Web Presence Book Signings

Book Signings Facebook Profile and Facebook Page

Facebook Profile and Facebook Page Active Social Media Participation

Active Social Media Participation Ebook Cards

Ebook Cards The Great Alaska Book Fair: October 8, 2016

The Great Alaska Book Fair: October 8, 2016

Costco Book Signings

Costco Book Signings eBook Cards

eBook Cards

Benjamin Franklin Award

Benjamin Franklin Award Jim Misko Book Signing at Barnes and Noble

Jim Misko Book Signing at Barnes and Noble

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex.

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex. Correction:

Correction: This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

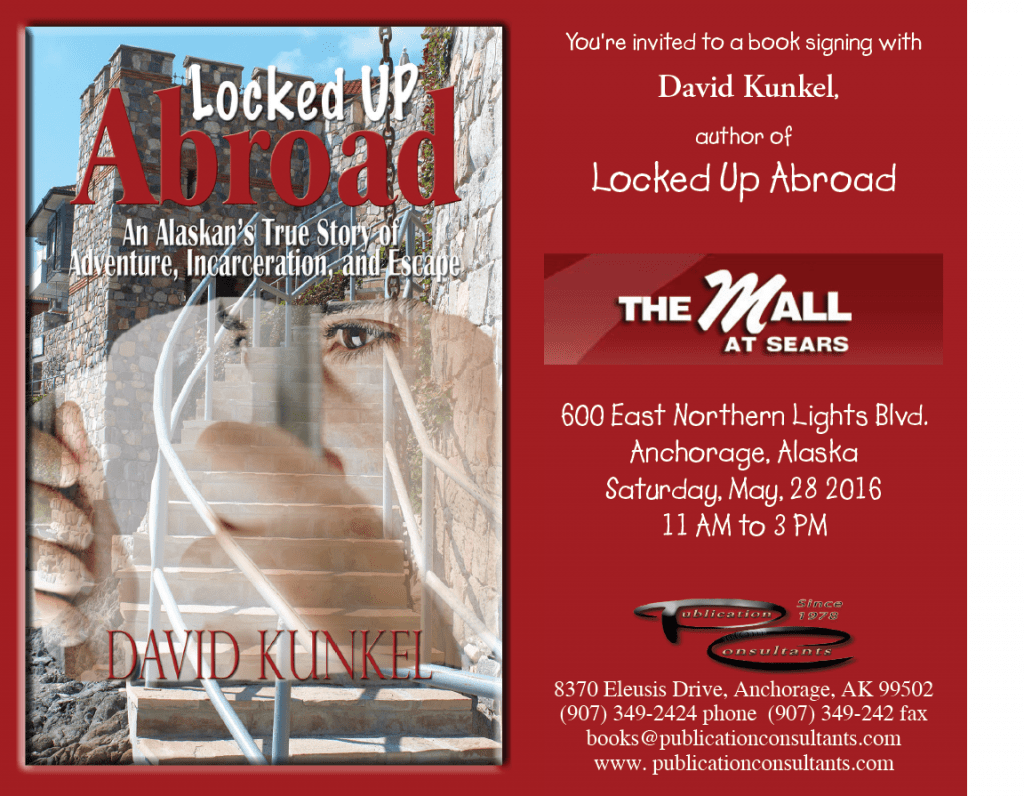

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, <

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, < We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

The Lyin Kings: The Wannabe World Leaders

The Lyin Kings: The Wannabe World Leaders

Time and Tide

Time and Tide

ReadAlaska 2014

ReadAlaska 2014 Readerlink and Book Signings

Readerlink and Book Signings

2014 Independent Publisher Book Awards Results

2014 Independent Publisher Book Awards Results

Bonnye Matthews Radio Interview

Bonnye Matthews Radio Interview

Rick Mystrom Radio Interview

Rick Mystrom Radio Interview When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores.

When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores. More NetGalley

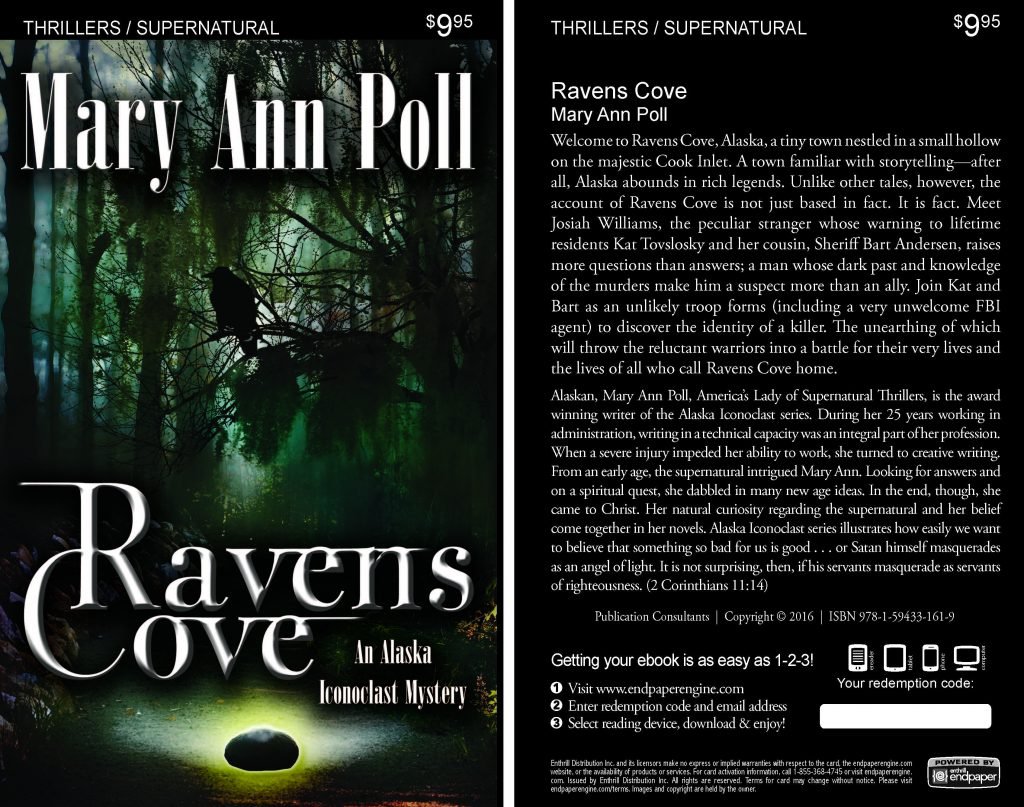

More NetGalley Mary Ann Poll

Mary Ann Poll

Bumppo

Bumppo

Computer Spell Checkers

Computer Spell Checkers Seven Things I Learned From a Foreign Email

Seven Things I Learned From a Foreign Email 2014 Spirit of Youth Awards

2014 Spirit of Youth Awards Book Signings

Book Signings

Blog Talk Radio

Blog Talk Radio Publication Consultants Blog

Publication Consultants Blog Book Signings

Book Signings

Don and Lanna Langdok

Don and Lanna Langdok Ron Walden

Ron Walden Book Signings Are Fun

Book Signings Are Fun Release Party Video

Release Party Video

Erin’s book,

Erin’s book,  Heather’s book,

Heather’s book,  New Books

New Books