Cedar Valley News

January 21, 2026

The Rent You Never Stop Paying

By: Lars Olson

From the fictional town of Cedar Valley, where characters from Quiet Echo continue to respond to real-world events.

Yesterday, George Khan told us about Gloria Gaynor—the ninety-one-year-old Pennsylvania grandmother who lost her $247,000 home over $3,500 in unpaid property taxes. This morning, a reader, Jesse Swensen, wrote in with a question that’s been rattling around in my head ever since: What if the tax were calculated on the loan’s value, and if you paid the house off, no tax at all?

It’s a carpenter’s kind of question. Simple. Practical. Aimed at the root of the problem.

It’s a carpenter’s kind of question. Simple. Practical. Aimed at the root of the problem.

Here’s what Jesse is getting at: under our current system, you never really own your home. You can pay the mortgage for thirty years, make that final payment, frame the satisfaction letter, hang it on the wall—and the tax bill still comes. Every year. Forever. Miss a payment, and they can take what you spent a lifetime earning.

Gloria Gaynor learned that the hard way. So have plenty of others.

Jesse’s idea flips the script. Tax the debt, not the asset. If you owe $200,000 on your mortgage, that’s your tax base. Pay it down to $50,000, and your taxes drop. Pay it off entirely, and the tax goes to zero. You’d actually own what you own.

I’ve been building things for forty years. When a customer asks me to solve a problem, I don’t just grab a hammer. I think it through. So, let’s think this one through.

Some will ask about renters. But a wise landlord with lower costs can lower rents, stay competitive, and keep good tenants longer. The market has a way of sorting these things out when you let it.

Some will ask about new buyers carrying more of the load. But that’s how it’s always worked. You start small. You build equity. You work your way toward owning something free and clear. That’s not a flaw in the system—that’s the path.

And some will ask about revenue. Two thoughts on that. First, government agencies do better budgeting when the money is harder to come by. Easy revenue makes for lazy spending. Second, other sources exist. Property taxes aren’t the only way to fund schools and roads—they’re just the way we’ve gotten used to.

The movement to end property taxes focuses on owner-occupied homes—and for good reason. This is about families. About people who’ve worked and saved and sacrificed to put a roof over their heads. It’s not about speculators or investment portfolios. It’s about the widow on Maple Street who shouldn’t have to choose between her medications and her tax bill.

Back on January 6th, Caleb Mercer wrote about abolishing property taxes entirely. I followed up a few days later with a different approach—a thirty-year homestead exemption. Live in your home for three decades, raise your family there, put down roots, and the tax phases out. You’ve paid your dues. You’ve contributed to the community. Now you get to keep what you built.

Jesse’s idea is in the same spirit. Tax the debt, not the home. Reward people for paying down what they owe. Give them something to work toward—real ownership, not perpetual obligation.

The details matter. But so does the principle. And the principle Jesse is pointing toward is this: if you work hard, play by the rules, and pay off your home, you ought to actually own it. Not rent it from the county. Own it.

Gloria Gaynor came to this country with nothing. She bought a house. She paid the mortgage. She did everything right. And now she’s being wheeled out of her own living room because the system decided her thirty-five hundred dollars mattered more than her thirty years of payments.

That’s not a system worth defending. That’s a system worth fixing.

Keep the ideas coming, Jesse. That’s how things change—one question at a time, from folks who aren’t afraid to ask why we do things the way we’ve always done them.

— Lars Olson is a Cedar Valley carpenter, small business owner, and lifelong advocate for the folks who build things with their hands. He believes hard work should lead somewhere—preferably to a home you actually own.

Jesse is a real reader who responded to yesterday’s column. Cedar Valley may be fictional, but the conversations here are real. If something in these editorials sparks a question or an idea, write to us. The best thinking doesn’t happen in isolation—it happens when neighbors talk.

This editorial is part of the fictional Cedar Valley News series. While the people and town are fictional, the national events they reflect on are real.

Want to know the full story behind Cedar Valley? Teresa, Caleb, Dan, and the community you’ve come to know in these editorials first came together in Quiet Echo: When Loud Voices Divide, Quiet Ones Bring Together. Discover how a small town found its way from fear to fellowship—one quiet act of courage at a time. Available on Amazon: https://bit.ly/3ME4nSs

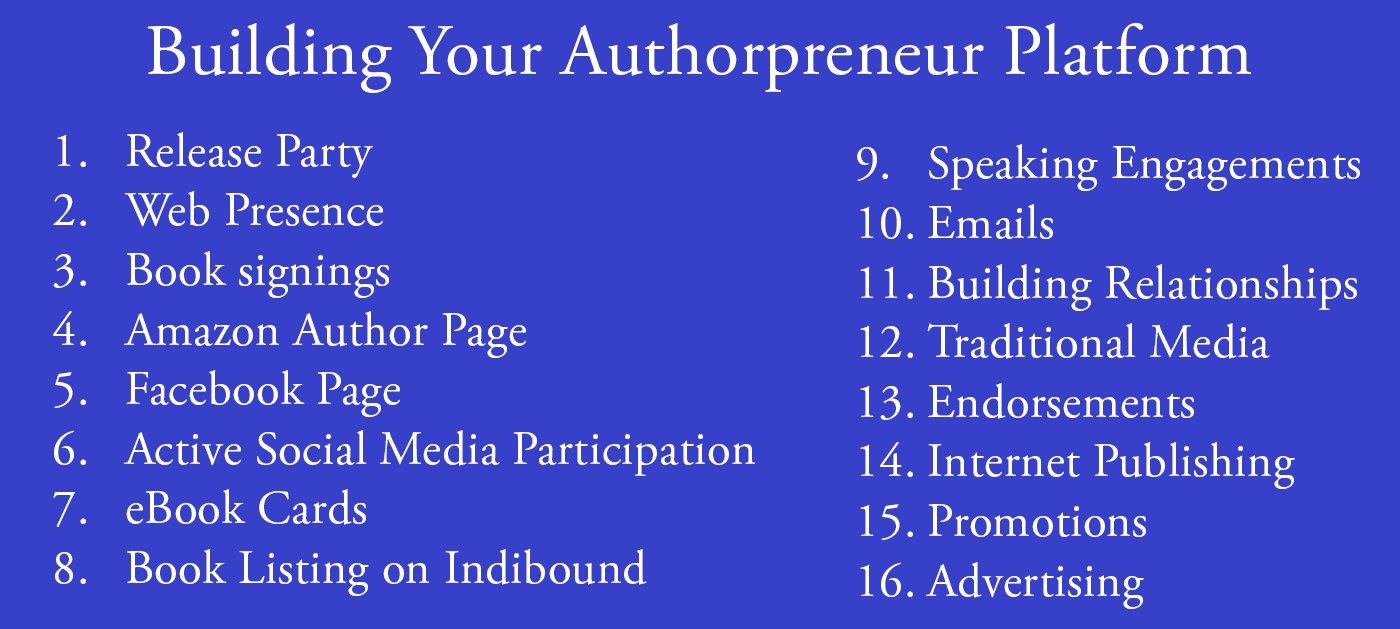

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them. Release Party

Release Party Web Presence

Web Presence Book Signings

Book Signings Facebook Profile and Facebook Page

Facebook Profile and Facebook Page Active Social Media Participation

Active Social Media Participation Ebook Cards

Ebook Cards The Great Alaska Book Fair: October 8, 2016

The Great Alaska Book Fair: October 8, 2016

Costco Book Signings

Costco Book Signings eBook Cards

eBook Cards

Benjamin Franklin Award

Benjamin Franklin Award Jim Misko Book Signing at Barnes and Noble

Jim Misko Book Signing at Barnes and Noble

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex.

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex. Correction:

Correction: This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

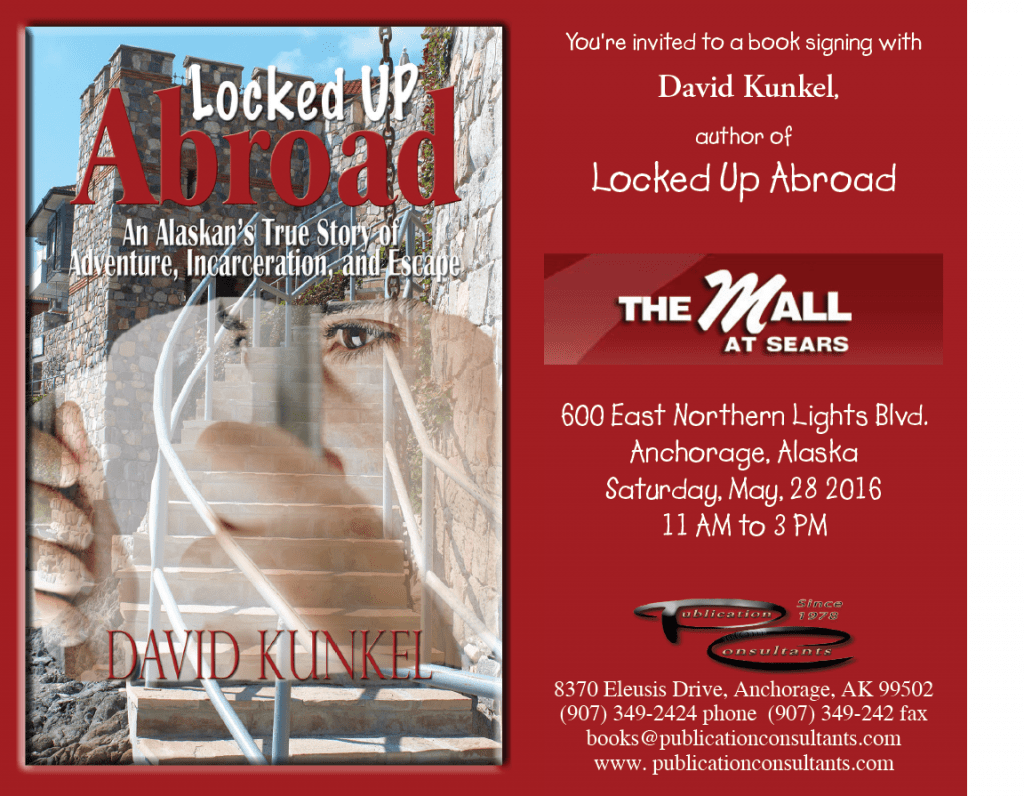

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, <

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, < We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

The Lyin Kings: The Wannabe World Leaders

The Lyin Kings: The Wannabe World Leaders

Time and Tide

Time and Tide

ReadAlaska 2014

ReadAlaska 2014 Readerlink and Book Signings

Readerlink and Book Signings

2014 Independent Publisher Book Awards Results

2014 Independent Publisher Book Awards Results

Bonnye Matthews Radio Interview

Bonnye Matthews Radio Interview

Rick Mystrom Radio Interview

Rick Mystrom Radio Interview When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores.

When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores. More NetGalley

More NetGalley Mary Ann Poll

Mary Ann Poll

Bumppo

Bumppo

Computer Spell Checkers

Computer Spell Checkers Seven Things I Learned From a Foreign Email

Seven Things I Learned From a Foreign Email 2014 Spirit of Youth Awards

2014 Spirit of Youth Awards Book Signings

Book Signings

Blog Talk Radio

Blog Talk Radio Publication Consultants Blog

Publication Consultants Blog Book Signings

Book Signings

Don and Lanna Langdok

Don and Lanna Langdok Ron Walden

Ron Walden Book Signings Are Fun

Book Signings Are Fun Release Party Video

Release Party Video

Erin’s book,

Erin’s book,  Heather’s book,

Heather’s book,  New Books

New Books