Cedar Valley News – February 11, 2026

The Dead Debt That Came Back to Life

By: Lars Olson

From the fictional town of Cedar Valley, where characters from Quiet Echo continue to respond to real-world events.

More than 600,000 Americans may lose their homes over debts they were told no longer existed. The debts are called zombie mortgages. And unless you have heard of them, you could be next.

If you took out a second mortgage before the 2008 financial crisis — a home equity loan, a line of credit, one of those 80/20 piggyback loans the banks handed out like candy — and you were later told it was forgiven, modified, or discharged in bankruptcy, do not assume it is gone. Debt collectors are buying those old loans for pennies on the dollar and coming after the houses of people who have spent fifteen years believing they were free and clear.

If you took out a second mortgage before the 2008 financial crisis — a home equity loan, a line of credit, one of those 80/20 piggyback loans the banks handed out like candy — and you were later told it was forgiven, modified, or discharged in bankruptcy, do not assume it is gone. Debt collectors are buying those old loans for pennies on the dollar and coming after the houses of people who have spent fifteen years believing they were free and clear.

PBS NewsHour ran the story last week. Bloomberg News investigated it in December. NPR found that in New York state alone, foreclosure actions had been filed on 10,000 old second mortgages in the past two years. The families being targeted are not wealthy. They are working people. A single father in Bowie, Maryland, named Terence Hardin bought his house twenty years ago, raised his family in it, and lost it to a zombie mortgage he never knew was still alive. Jerry and Sharon Lomurno in Madison, Ohio, took out a $30,000 second mortgage in 2006. They were told it was discharged in bankruptcy. Fifteen years later, a debt collector called and told them they owed $80,000 — the original amount plus retroactive interest charged for every month nobody sent them a statement.

Here is how it works. Before the 2008 crash, banks issued millions of second mortgages. When the housing market collapsed, those second loans became worthless — the houses were not worth enough to cover even the first mortgage. Banks stopped sending statements. Some told borrowers the debt was forgiven. Some borrowers went through bankruptcy and believed the second lien was discharged. The debt went silent. For ten years, fifteen years, not a word.

Then home prices recovered. A house that was underwater in 2009 might be worth twice its purchase price today. Suddenly those dead second mortgages had value again. Investors and debt collectors bought them in bulk — sometimes for three or four cents on the dollar — and began contacting homeowners. One debt buyer described his strategy on a podcast: buy a million dollars in non-performing second mortgages, collect $2.2 to $2.5 million. If the homeowner refuses to pay, start the foreclosure process.

The homeowner finds out when a stranger shows up in the yard or a letter arrives from a law firm. A debt they were told was dead is now alive, swollen with years of interest nobody told them was accruing, and attached to the only asset most working families will ever own.

The Consumer Financial Protection Bureau — the federal agency created after the 2008 crisis specifically to protect people from this kind of predatory behavior — had been investigating zombie debt collectors. It had warned that federal law requires debt collectors to send periodic statements and that it is illegal to sue homeowners on debts past the statute of limitations. But the CFPB’s enforcement work was essentially shut down by the Trump administration last February. The agency that was supposed to be the watchman is no longer watching.

That leaves homeowners on their own.

I bring this to Cedar Valley because it could happen here. If you bought a home before 2008 and took out any kind of second mortgage or home equity line, and if you were told at any point that the debt was resolved, you need to check. Do not take anyone’s word for it. Go to your county recorder’s office and look at the title. If a lien is still recorded against your property, the debt is not dead — no matter what someone told you on the phone fifteen years ago.

If a debt collector contacts you about an old second mortgage, do not pay anything before you talk to an attorney. Do not confirm the debt on the phone. File a complaint with the CFPB, even in its diminished state, because the record matters. And talk to a lawyer who understands mortgage law in your state. Legal aid societies handle these cases. Attorney Kristi Kelly has filed class action lawsuits against zombie mortgage collectors on behalf of homeowners who were charged retroactive interest for years they never received a single statement.

This is not a story about people who failed to pay their bills. This is a story about a system that failed the people inside it. The banks made the loans. The banks collapsed. The government spent billions modifying first mortgages but left millions of second mortgages in limbo. Then the agency built to clean up the mess was gutted. And now private debt collectors are harvesting the wreckage, one family at a time.

In Cedar Valley, we believe a man should pay what he owes. But we also believe that when a bank tells you a debt is gone, it should be gone. When a bankruptcy court discharges a lien, it should stay discharged. And when a debt collector shows up fifteen years later with a bill inflated by interest that was never disclosed, that is not free enterprise. That is a shakedown.

Check your title. Talk to your neighbors. If you know someone who bought a home before the crash and took out a second mortgage, tell them about this column. The zombie is not coming for everyone. But the people it is coming for deserve a warning before it reaches the door.

Nobody in Cedar Valley should lose a home to a debt they were told was dead. Not on our watch.

This editorial is part of the fictional Cedar Valley News series. While the people and town are fictional, the national events they reflect on are real.

Want to know the full story behind Cedar Valley? Teresa, Caleb, Dan, and the community you’ve come to know in these editorials first came together in Quiet Echor. Discover how a small town found its way from fear to fellowship — one quiet act of courage at a time. Available on Amazon: https://bit.ly/3ME4nSs

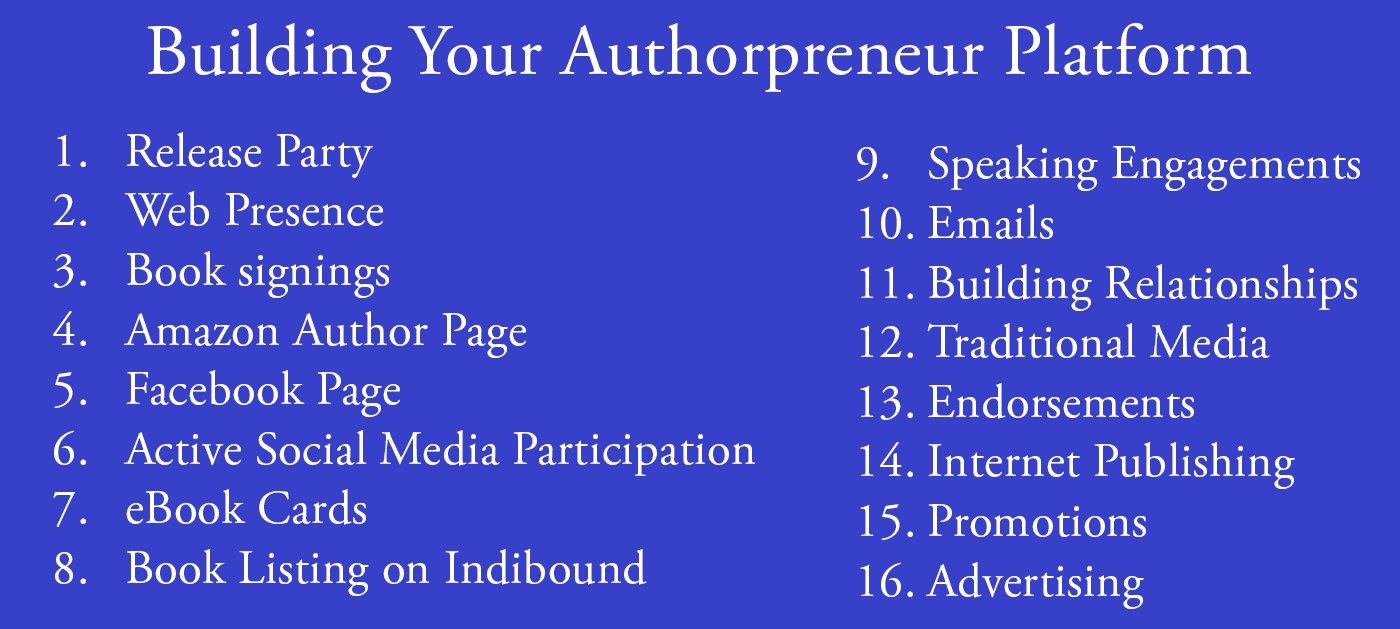

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them. Release Party

Release Party Web Presence

Web Presence Book Signings

Book Signings Facebook Profile and Facebook Page

Facebook Profile and Facebook Page Active Social Media Participation

Active Social Media Participation Ebook Cards

Ebook Cards The Great Alaska Book Fair: October 8, 2016

The Great Alaska Book Fair: October 8, 2016

Costco Book Signings

Costco Book Signings eBook Cards

eBook Cards

Benjamin Franklin Award

Benjamin Franklin Award Jim Misko Book Signing at Barnes and Noble

Jim Misko Book Signing at Barnes and Noble

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex.

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex. Correction:

Correction: This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

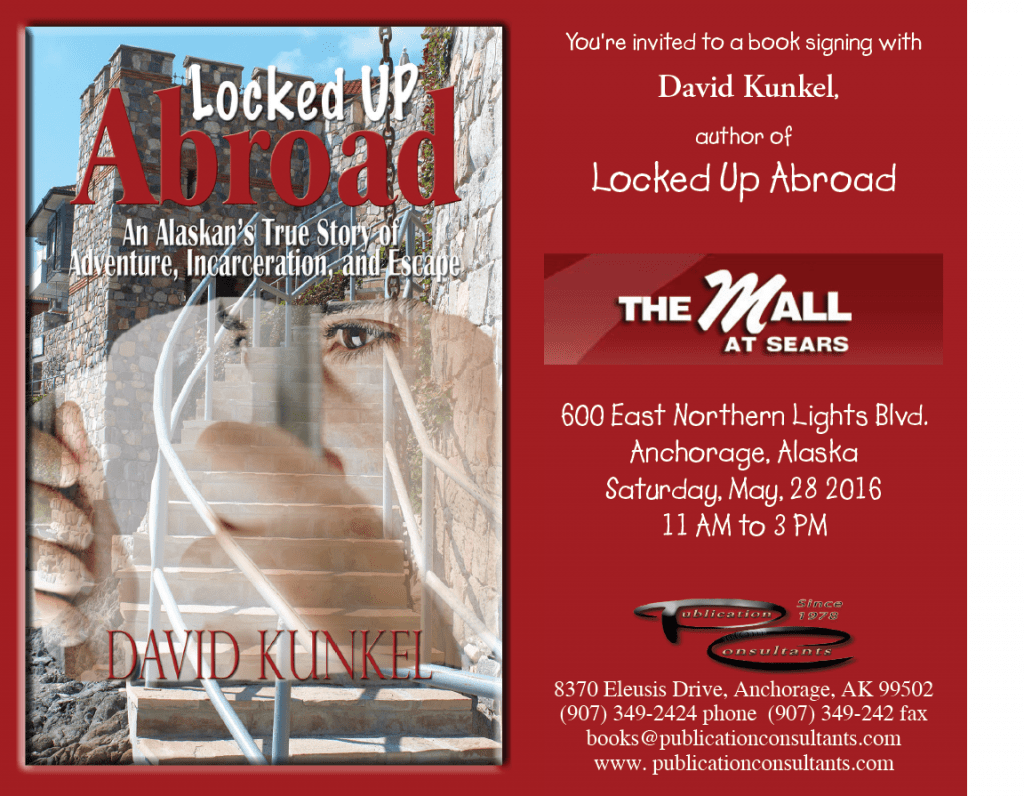

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, <

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, < We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

The Lyin Kings: The Wannabe World Leaders

The Lyin Kings: The Wannabe World Leaders

Time and Tide

Time and Tide

ReadAlaska 2014

ReadAlaska 2014 Readerlink and Book Signings

Readerlink and Book Signings

2014 Independent Publisher Book Awards Results

2014 Independent Publisher Book Awards Results

Bonnye Matthews Radio Interview

Bonnye Matthews Radio Interview

Rick Mystrom Radio Interview

Rick Mystrom Radio Interview When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores.

When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores. More NetGalley

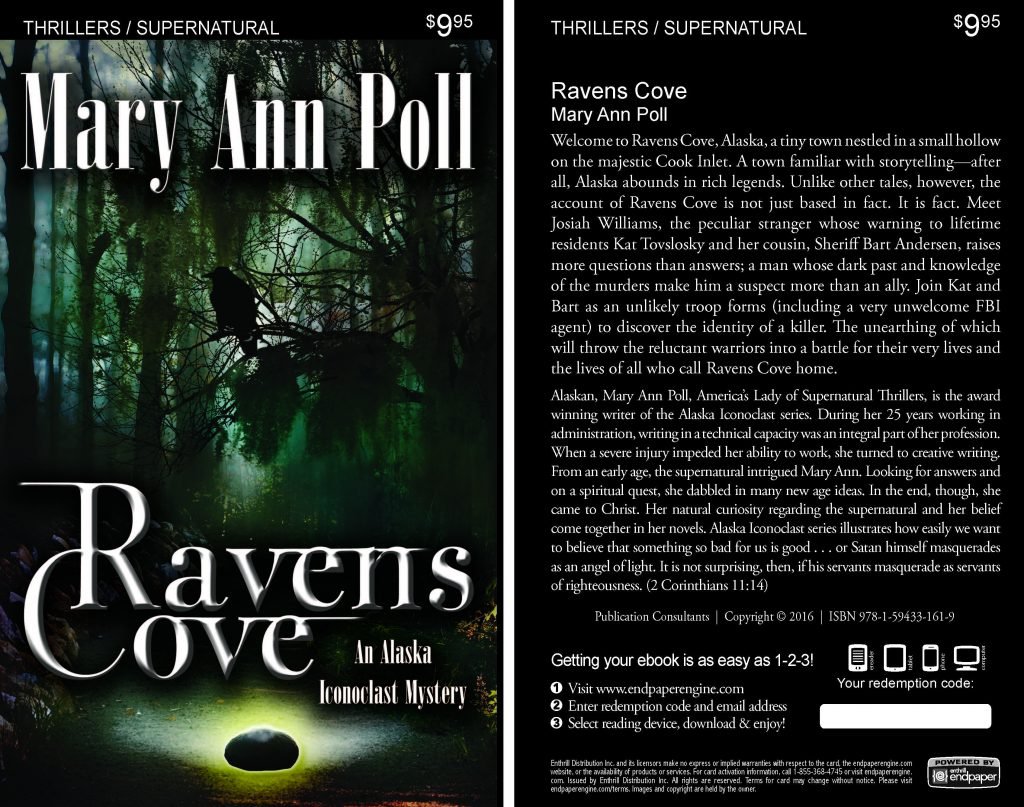

More NetGalley Mary Ann Poll

Mary Ann Poll

Bumppo

Bumppo

Computer Spell Checkers

Computer Spell Checkers Seven Things I Learned From a Foreign Email

Seven Things I Learned From a Foreign Email 2014 Spirit of Youth Awards

2014 Spirit of Youth Awards Book Signings

Book Signings

Blog Talk Radio

Blog Talk Radio Publication Consultants Blog

Publication Consultants Blog Book Signings

Book Signings

Don and Lanna Langdok

Don and Lanna Langdok Ron Walden

Ron Walden Book Signings Are Fun

Book Signings Are Fun Release Party Video

Release Party Video

Erin’s book,

Erin’s book,  Heather’s book,

Heather’s book,  New Books

New Books