By: Teresa Nikas, Editor

From the fictional town of Cedar Valley, where characters from Quiet Echo continue to respond to real-world events.

The new pitch for fifty-year mortgages sounds like progress—another clever way to help families buy homes—but beneath the soft language hides a hard truth. A loan stretched over half a century doesn’t create opportunity; it manufactures dependency. A fifty-year mortgage keeps families paying until the roof wears out, the children move away, and the retirement clock runs out.

This kind of financing doesn’t make homes more affordable; it only makes debt last longer. The borrower might hold the keys, but the bank still owns the lock. Equity grows at a crawl, and by the time it builds, so have property taxes, insurance, and inflation. The dream of ownership becomes a permanent payment plan.

Now imagine an alternative—one bold enough to rewire the whole system. If government took over the mortgage business and offered fixed-rate 2% loans to families buying their primary homes, both people and government would prosper. Citizens would enjoy smaller payments and faster equity. Government would gain a steady stream of revenue—interest that stays in the public treasury instead of enriching private lenders. That income could maintain roads, schools, and community programs without draining wallets through yearly property taxes.

In fact, with the right structure, property tax could disappear altogether. The modest interest collected from millions of 2% mortgages could replace the property tax burden entirely. Instead of citizens paying two masters—the bank and the tax assessor—they’d make a single, fair payment that builds both personal equity and public good.

Such a system would do more than balance books; it would rebalance lives. Money now lost to mortgage interest and property tax would stay local. Families would have more to spend on repairs, education, and local businesses. Towns like Cedar Valley would thrive again—hardware stores bustling, schools funded through earned interest rather than punitive levies, and communities investing in themselves instead of appeasing distant financiers.

A fifty-year mortgage is a chain disguised as a lifeline. A 2% government-backed mortgage is a bridge—to ownership, stability, and shared prosperity. It restores the promise that a home isn’t supposed to make someone rich—it’s supposed to make someone rooted.

Maybe that’s the kind of mortgage worth signing.

This editorial is part of the fictional Cedar Valley News series. While the people and town are fictional, the national events they reflect on are real.

It’s free, live, and fresh! Quiet Echo—A Cedar Valley News Podcast is live on Apple Podcasts: https://bit.ly/4nV8XsE, Spotify: https://bit.ly/4hdNHfX, YouTube: https://bit.ly/48Zfu1g , and Podcastle: https://bit.ly/4pYRstE. Every day, you can hear Cedar Valley’s editorials read aloud by the voices you’ve come to know—warm, steady, and rooted in the values we share. Step into the rhythm of our town, one short reflection at a time. Wherever you listen, you’ll feel right at home. Presented by the Readers and Writers Book Club: https://bit.ly/3KLTyg4

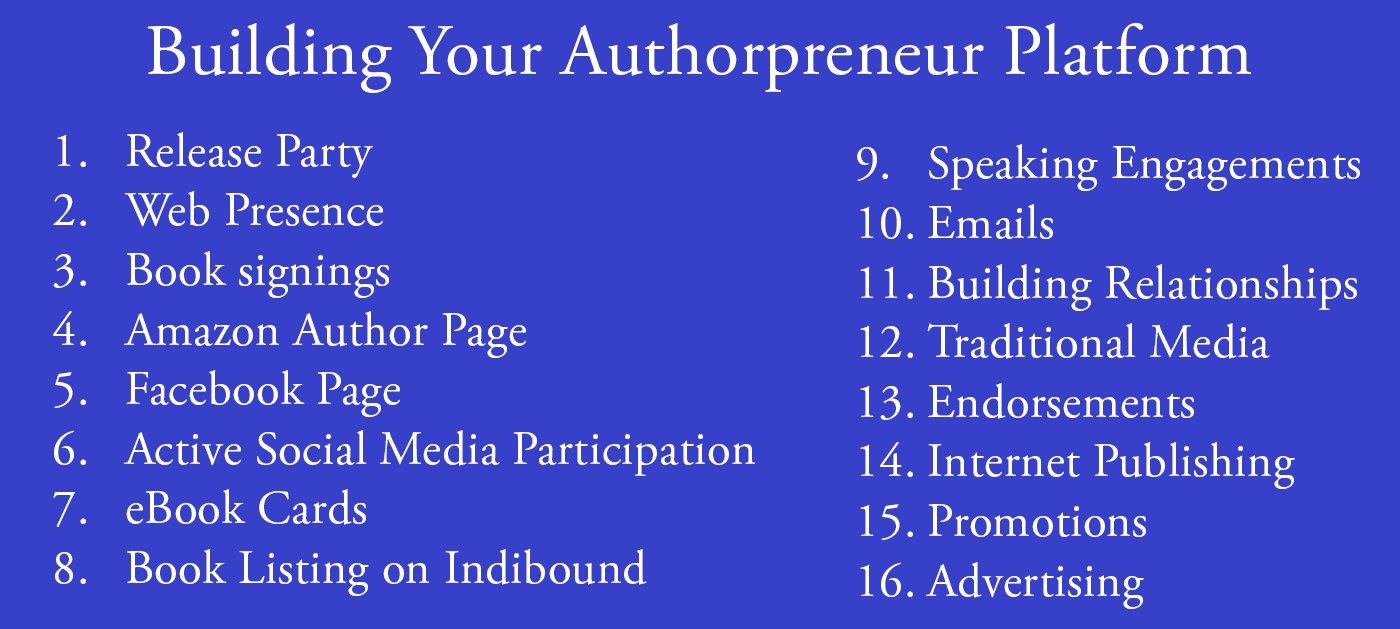

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. Author Campaign Method (ACM) of sales and marketing is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authorpreneurs who are serious about bringing their books to market. ACM is a boon for them. Release Party

Release Party Web Presence

Web Presence Book Signings

Book Signings Facebook Profile and Facebook Page

Facebook Profile and Facebook Page Active Social Media Participation

Active Social Media Participation Ebook Cards

Ebook Cards The Great Alaska Book Fair: October 8, 2016

The Great Alaska Book Fair: October 8, 2016

Costco Book Signings

Costco Book Signings eBook Cards

eBook Cards

Benjamin Franklin Award

Benjamin Franklin Award Jim Misko Book Signing at Barnes and Noble

Jim Misko Book Signing at Barnes and Noble

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex.

Cortex is for serious authors and will probably not be of interest to hobbyists. We recorded our Cortex training and information meeting. If you’re a serious author, and did not attend the meeting, and would like to review the training information, kindly let us know. Authors are required to have a Facebook author page to use Cortex. Correction:

Correction: This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

This is Publication Consultants’ motivation for constantly striving to assist authors sell and market their books. ACM is Publication Consultants’ plan to accomplish this so that our authors’ books have a reasonable opportunity for success. We know the difference between motion and direction. ACM is direction! ACM is the process for authors who are serious about bringing their books to market. ACM is a boon for serious authors, but a burden for hobbyist. We don’t recommend ACM for hobbyists.

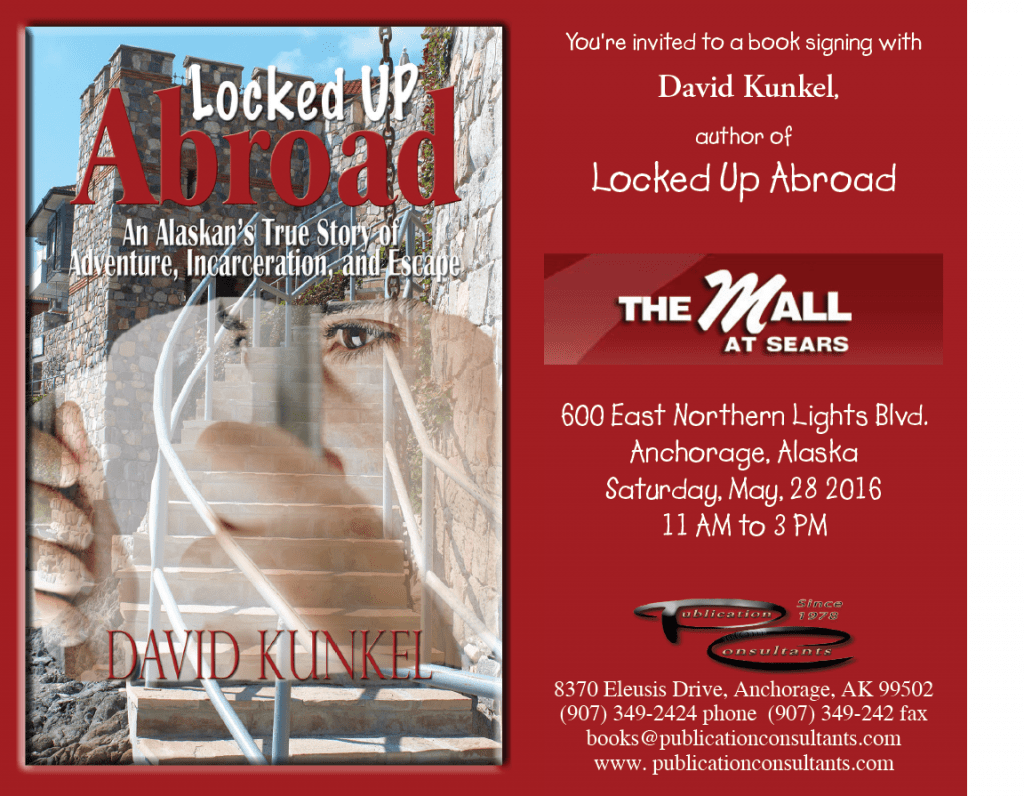

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, <

We’re the only publisher we know of that provides authors with book signing opportunities. Book signing are appropriate for hobbyist and essential for serious authors. To schedule a book signing kindly go to our website, < We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

We hear authors complain about all the personal stuff on Facebook. Most of these complaints are because the author doesn’t understand the difference difference between a Facebook profile and a Facebook page. Simply put, a profile is for personal things for friends and family; a page is for business. If your book is just a hobby, then it’s fine to have only a Facebook profile and make your posts for friends and family; however, if you’re serious about your writing, and it’s a business with you, or you want it to be business, then you need a Facebook page as an author. It’s simple to tell if it’s a page or a profile. A profile shows how many friends and a page shows how many likes. Here’s a link <> to a straight forward description on how to set up your author Facebook page.

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

Mosquito Books has a new location in the Anchorage international airport and is available for signings with 21 days notice. Jim Misko had a signing there yesterday. His signing report included these words, “Had the best day ever at the airport . . ..”

The Lyin Kings: The Wannabe World Leaders

The Lyin Kings: The Wannabe World Leaders

Time and Tide

Time and Tide

ReadAlaska 2014

ReadAlaska 2014 Readerlink and Book Signings

Readerlink and Book Signings

2014 Independent Publisher Book Awards Results

2014 Independent Publisher Book Awards Results

Bonnye Matthews Radio Interview

Bonnye Matthews Radio Interview

Rick Mystrom Radio Interview

Rick Mystrom Radio Interview When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores.

When he published those overseas blogs as the book The Innocents Abroad, it would become a hit. But you couldn’t find it in bookstores. More NetGalley

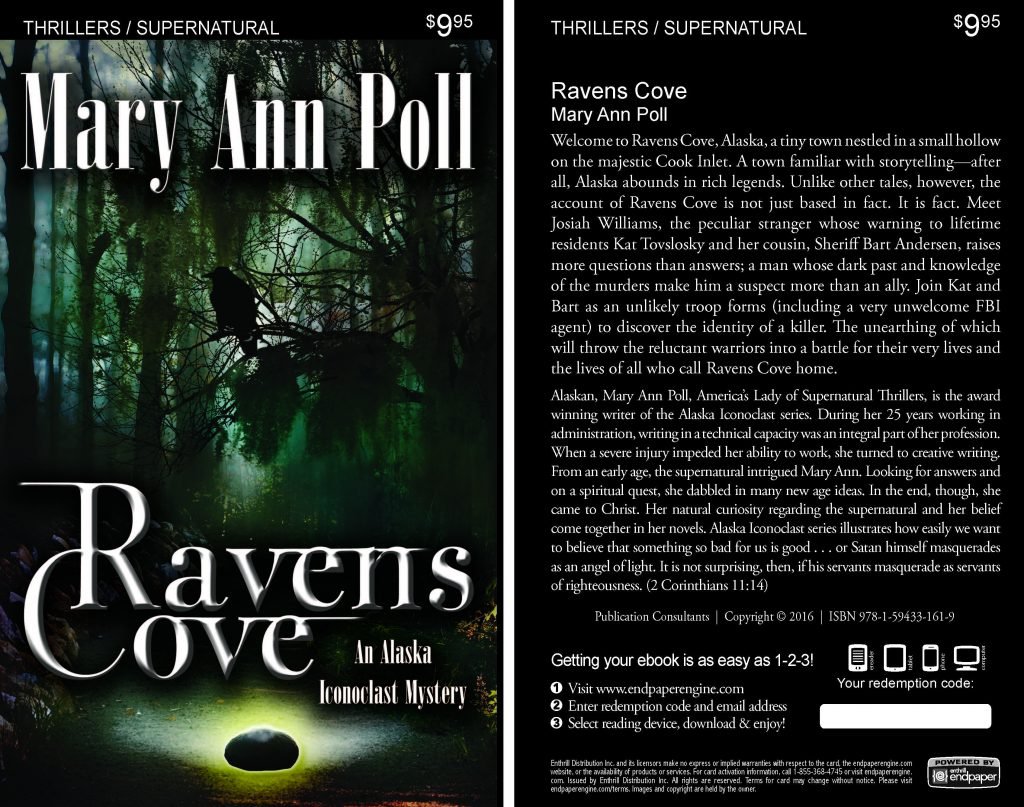

More NetGalley Mary Ann Poll

Mary Ann Poll

Bumppo

Bumppo

Computer Spell Checkers

Computer Spell Checkers Seven Things I Learned From a Foreign Email

Seven Things I Learned From a Foreign Email 2014 Spirit of Youth Awards

2014 Spirit of Youth Awards Book Signings

Book Signings

Blog Talk Radio

Blog Talk Radio Publication Consultants Blog

Publication Consultants Blog Book Signings

Book Signings

Don and Lanna Langdok

Don and Lanna Langdok Ron Walden

Ron Walden Book Signings Are Fun

Book Signings Are Fun Release Party Video

Release Party Video

Erin’s book,

Erin’s book,  Heather’s book,

Heather’s book,  New Books

New Books